Schedule C Irs 2025 - How to Complete IRS Schedule C, Schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. Tax Calculator 2025 Irs John Walker, Irs schedule c is a tax form for reporting profit or loss from a business.

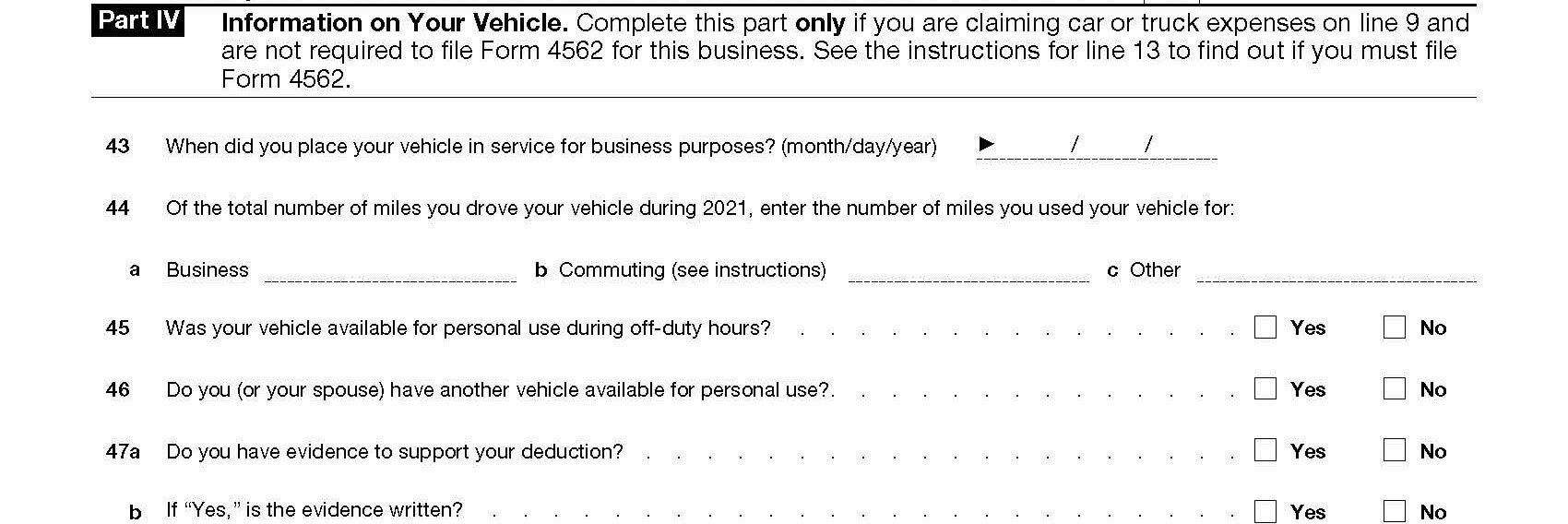

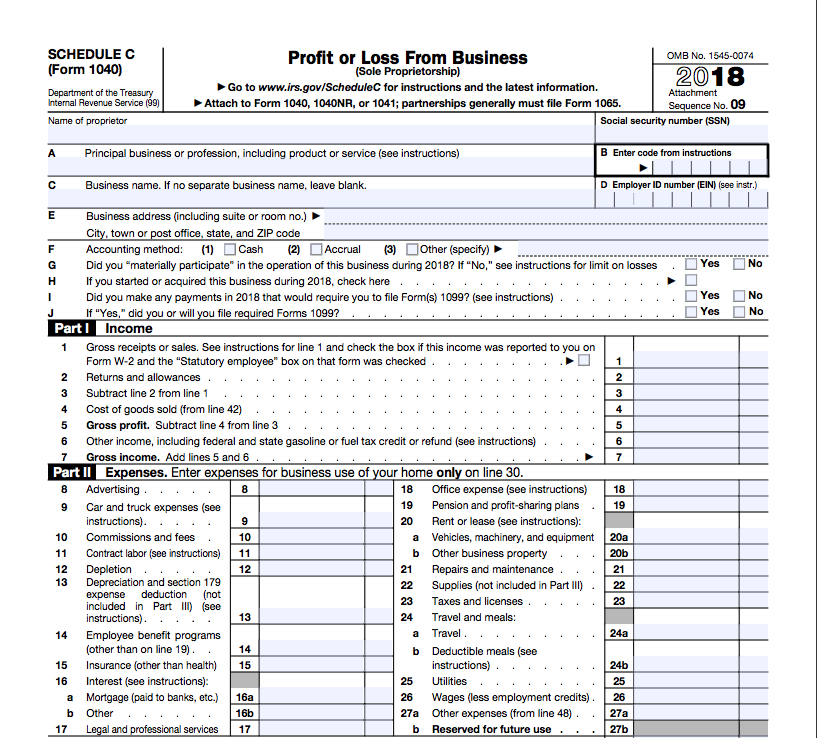

How to Complete IRS Schedule C, Schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses.

IRS Schedule C Walkthrough (Profit or Loss from Business) YouTube, Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Schedule C Form 2025 2025 josey marris, List your business income in part i, including sales for the year, amounts.

2025 Instructions For Schedule C Sam Leslie, Married taxpayers filing jointly 2025 projected tax brackets.

Schedule C Irs 2025. See current federal tax brackets and rates based on your income and filing status. In 2025, the deadline for filing your individual income tax return and paying.

Free Printable Schedule C Tax Form, Profit or loss from business (form 1040)?

Form Schedule C Report 1099 And Expenses FlyFin, A handful of tax provisions, including the standard deduction and tax brackets, will see new limits and.

Schedule C What Is It, How To Fill, Example, Vs Schedule E, If you’re in a partnership, you’ll report those expenses on form 1065,.

Irs Schedule C Instructions 2025 Rodi Vivian, Schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses.

If you’re in a partnership, you’ll report those expenses on form 1065,. This goes for all sole.